How Business Restructuring Relief Affects Your UAE Corporate Tax

UAE businesses are facing a new financial reality with the introduction of Corporate Tax. As a local company owner, you might wonder how this affects your bottom line. FMCA understands your concerns. The Corporate Tax UAE, set at a competitive 9% rate, applies to businesses earning over AED 375,000 annually. But there’s a silver lining – business restructuring relief. This provision could significantly impact how much tax you pay. Understanding this relief is crucial whether you’re a small startup or an established corporation. It could mean the difference between a hefty tax bill and substantial savings. In this ever-changing tax landscape, staying informed is key to making smart business decisions. That’s why FMCA is here to guide you through the ins and outs of business restructuring relief and how it affects your UAE Corporate Tax situation.

Understanding UAE Corporate Tax Basics

Corporate Tax in the UAE is a new federal tax on business profits. It’s part of the country’s efforts to diversify its economy and align with global tax practices. But what does this mean for you? If your business earns more than AED 375,000 yearly, you must pay this tax. This applies to most companies operating in the UAE, including free zone entities. However, there are exceptions, like government entities and natural resource extraction companies. The tax rate is set at 9% for taxable income above AED 375,000, with a 0% rate for income up to this threshold. Key aspects of UAE Corporate Tax laws include provisions for group relief, foreign tax credits, and transfer pricing rules. Understanding these basics is crucial for your business planning.

Restructuring Relief for UAE-Based Businesses

Business restructuring relief is a key feature of the UAE Corporate Tax framework, designed to help companies reorganize without immediate tax consequences.In simple terms, this relief allows you to transfer assets or businesses between companies in the same group without triggering Corporate Tax. This can be a game-changer for many UAE businesses looking to streamline operations or adapt to market changes. To be eligible for this relief, your company must meet certain criteria. Typically, both the transferring and receiving entities should be UAE residents and part of the same group. The transfer must be for valid commercial reasons, not just for tax avoidance.

How does this fit into the broader UAE Corporate Tax landscape? It’s part of the government’s effort to create a business-friendly tax environment. By allowing tax-neutral restructuring, the UAE aims to encourage economic growth and flexibility.

For many businesses, this relief could mean significant savings and opportunities. However, navigating the complexities of Corporate Tax Laws UAE can be challenging. That’s where Corporate Tax Consultants UAE come in. At FMCA, our Corporate Tax services UAE can help you understand if restructuring relief is right for your business and guide you through the process.

Impact of Restructuring Relief on Your Corporate Tax

Restructuring relief can significantly impact your UAE Corporate Tax situation. Let’s break down what this means for your business. First, consider the potential tax savings. Without this relief, transferring assets or businesses within your group could trigger immediate tax liabilities. But with restructuring relief, you can defer these taxes. For example, if you’re moving a profitable division to another company within your group, you won’t have to pay tax on the gains from this transfer right away. This could mean substantial savings, freeing up cash for other business needs.

However, these benefits come with changes in your tax reporting requirements. You’ll need to keep detailed records of any transfers made under the restructuring relief. This includes documenting the assets transferred, their market value, and the commercial reasons for the restructuring. FMCA’s Corporate Tax services UAE can help you maintain accurate records and ensure compliance.

How does this affect your overall tax strategy?

Restructuring relief offers a powerful tool for tax planning. It allows you to reorganize your business structure in response to market changes or growth opportunities without immediate tax consequences. You might use it to consolidate profitable and loss-making entities, potentially reducing your overall tax bill.

But remember, while the relief defers tax, it doesn’t eliminate it entirely. You’ll need to factor in future tax implications when the transferred assets are eventually sold or the receiving entity is disposed of. This is where Corporate Tax Consultants UAE can provide valuable insights.

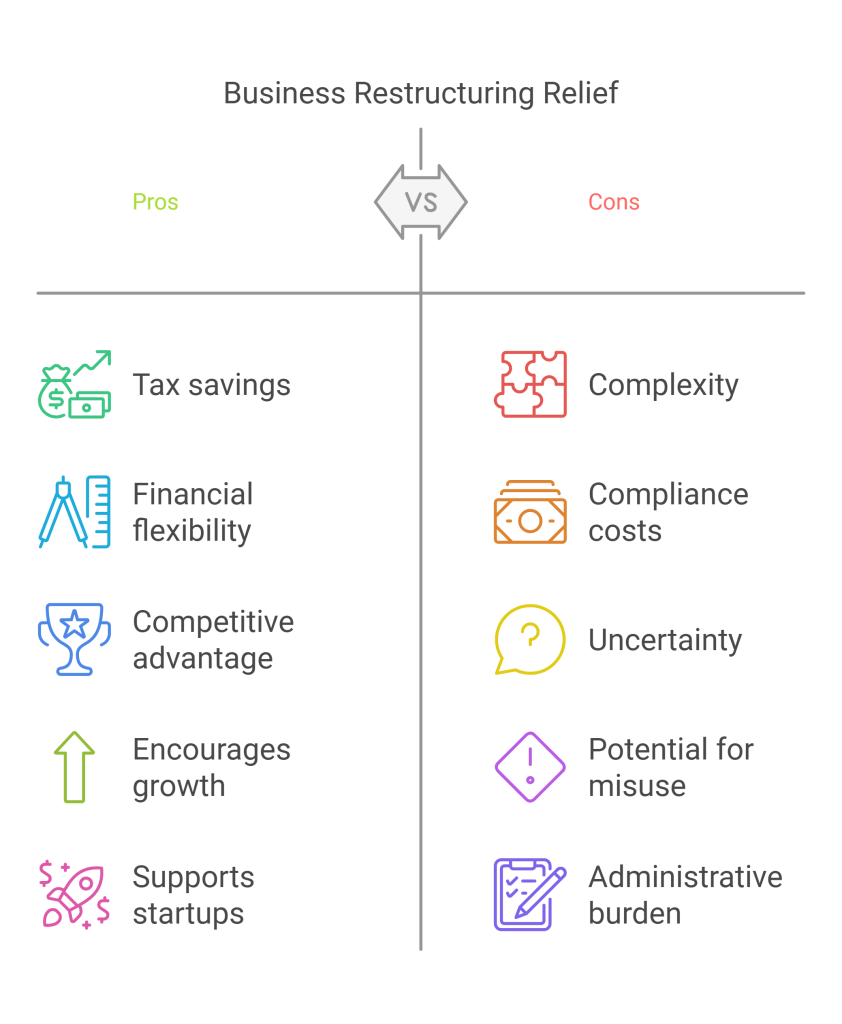

Pros and Cons of Electing for Restructuring Relief

Understanding the Pros and Cons of Electing for Restructuring Relief is essential for businesses navigating the new Corporate Tax laws in the UAE. This decision can impact your financial health significantly, so let’s break it down.

Advantages for Businesses

Choosing restructuring relief can offer several benefits. First, it allows companies to reorganize their operations to optimize tax liabilities under the Corporate Tax laws in the UAE. By restructuring, businesses might qualify for exemptions or lower tax rates, which can lead to substantial savings. Additionally, restructuring can improve operational efficiency by aligning resources more effectively, making it easier to adapt to market changes.

Potential Drawbacks or Risks

However, there are risks involved. Restructuring can be costly and time-consuming, requiring professional guidance from Corporate Tax consultants in the UAE. If not done correctly, businesses might face unexpected tax liabilities or penalties due to non-compliance with the new regulations. Moreover, frequent restructuring could raise red flags with tax authorities, leading to audits.

Factors to Consider Before Making a Decision

Before opting for restructuring relief, businesses should evaluate several factors. Understanding your current financial situation is crucial; assess how restructuring aligns with your long-term goals. Consulting with experienced Corporate Tax services in the UAE can provide insights into potential benefits and pitfalls. Lastly, consider the stability of your business model; if your operations are not robust, restructuring may not yield the desired results.

To apply for Business Restructuring Relief under the Corporate Tax laws in the UAE, follow this straightforward step-by-step process:

Step-by-Step Process

- Determine Eligibility: Ensure your business meets the conditions outlined in the UAE Corporate Tax Law. This includes being compliant with local regulations and ensuring both the transferor and transferee are not exempt persons.

- Prepare Documentation: Gather necessary documents, including:

- Financial statements showing net book values of assets and liabilities.

- Legal documents proving compliance with UAE laws.

- Any agreements related to the restructuring (mergers, demergers, etc.).

- Elect for Relief: When filing your corporate tax return, explicitly elect for the Business Restructuring Relief. This is crucial as no separate application is needed.

Common Pitfalls to Avoid

- Ignoring Compliance: Ensure all transactions comply with UAE regulations; failure to do so can disqualify you from relief.

- Delaying Documentation: Prepare your documentation early to avoid last-minute issues that could hinder your application.

- Misunderstanding Conditions: Familiarize yourself with the specific conditions required for eligibility, as overlooking these can lead to complications.

By following these steps and avoiding common mistakes, you can effectively navigate the process of applying for Business Restructuring Relief.

Role of Corporate Tax Consultants UAE in Restructuring

Corporate Tax Consultants in the UAE play a vital role in helping businesses navigate the complexities of Business Restructuring Relief. Their expertise is crucial for ensuring compliance with the ever-evolving Corporate Tax laws in the UAE.

How Consultants Can Help Navigate the Process

Corporate tax consultants guide businesses through the restructuring process by interpreting complex regulations and ensuring all necessary documentation is in order. They help identify eligibility for relief, which can significantly reduce tax liabilities during restructuring.

Benefits of Professional Corporate Tax Services UAE

Engaging professional Corporate Tax services in the UAE offers numerous advantages. Consultants can optimize tax efficiency, identify legitimate deductions, and ensure compliance with local laws, all of which can lead to substantial financial savings.

What to Look for in a Corporate Tax Consultant

When selecting a consultant, consider their experience with local tax laws, their ability to provide tailored strategies, and their track record of successful client outcomes. A good consultant should also offer clear communication and ongoing support.

Conclusion

In summary, Corporate Tax Consultants are essential for navigating the complexities of Business Restructuring Relief. Their expertise ensures informed decision-making and compliance with Corporate Tax laws in the UAE. Businesses are encouraged to seek professional advice to maximize benefits and minimize risks, ultimately fostering long-term success.